In 1943, King County Rural Library District was established as a “special purpose” district to provide library service to residents of rural King County. Similar to other special purpose districts, such as school, fire, and water districts, KCLS is an independent entity—it is not part of King County government and does not receive funding from King County’s budget. KCLS’ annual budget is funded predominantly through property tax revenues.

Today, King County Library System (KCLS) operates 50 libraries serving more than one million patrons across the county. The property tax revenue KCLS receives is distributed among all 50 libraries to ensure equitable service for the urban, suburban and rural communities KCLS serves.

Frequently Asked Questions

-

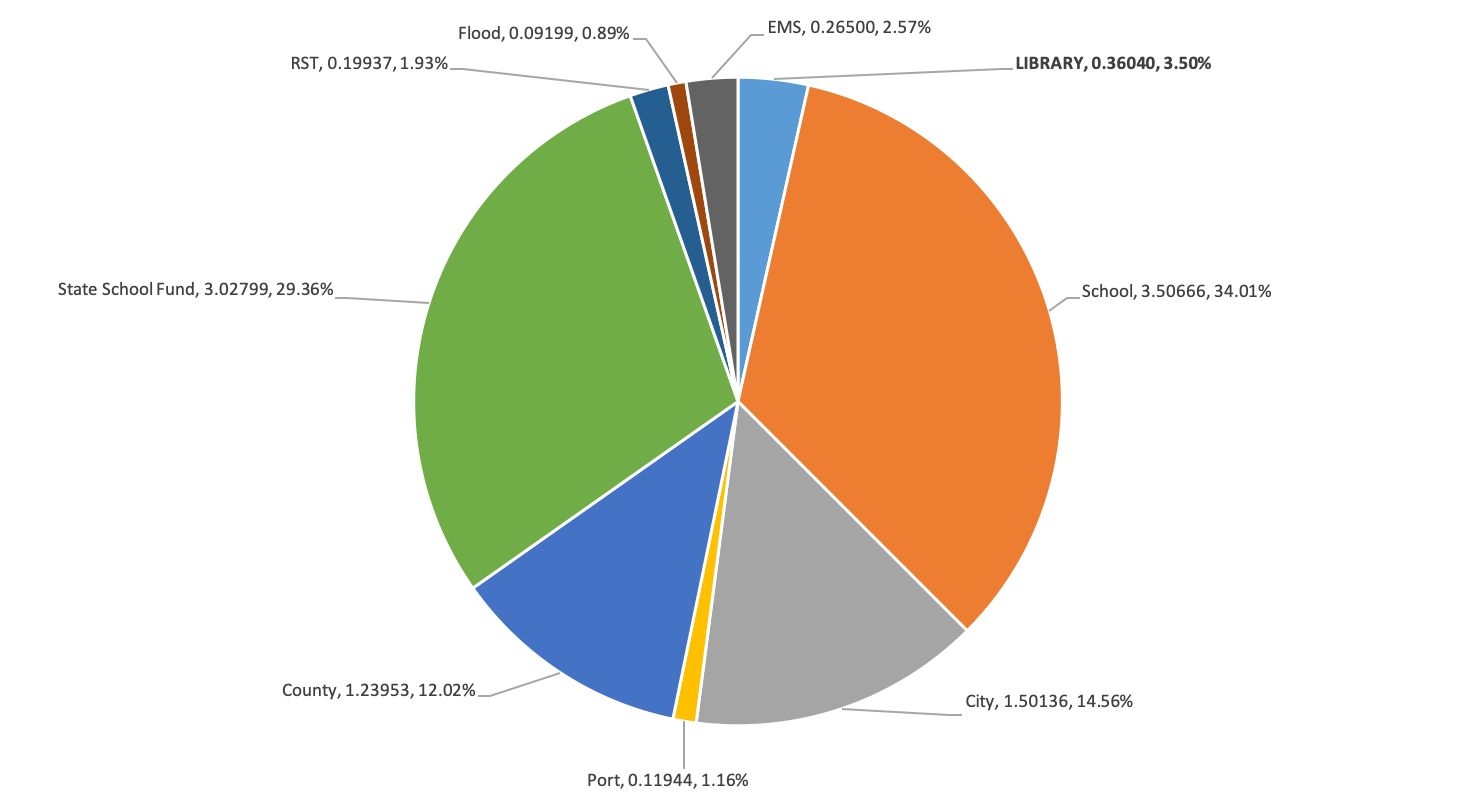

The following chart illustrates how property taxes are allocated for various public services, including library service.

Source: Adapted from King County Department of Assessments Parcel Viewer 2020 Property Report for a randomly-selected residential property in KCLS’ service area. Figures will vary by city. For example, if a homeowner’s total 2020 property tax bill is $10,000, the amount allocated for library service is $350 ($10,000 x 3.50%).

-

County residents have approved ballot measures supporting library operating and capital levies only five times since the Library District was established in 1943.

January 4, 1943

King County Rural Library District is established by the King County Board of Commissioners as directed by a majority vote of rural county residents on November 3, 1942.

November 8, 1966

KCLS’ first capital levy is approved by voters. The $6 million capital bond will fund 24 library projects to be completed by 1977.

YES: 61.1%

NO: 38.9%

September 20, 1988

Voters approve a $67 million capital levy. At the time, it is the largest library capital bond ever passed.

YES: 63.9%

NO: 36.1%

February 5, 2002

Voters approve a levy lid lift, restoring the operating levy to $0.50 per $1,000 of assessed value.

YES: 64.04%

NO: 35.96%

September 14, 2004

Voters approve a $172 million capital levy. Capital Bond funds will be used to construct 16 new libraries, renovate 14 libraries, and expand 11 libraries and two parking lots.

YES: 63.57%

NO: 36.43%

February 9, 2010

Voters approve a levy lid lift, restoring the operating levy to $0.50 per $1,000 of assessed value.

YES: 52.09%

NO: 47.93%